- Home

Why Choose SD

Services

- Services

Tax Services

Tax Planning

Attestation Services

Accounting Services

Business Services

Consultation

Industries We Serve

- Tax Center

Resources

Get In Touch

SD Associates, P.C. CPAs

Personal Returns

Experience The SD Difference

Personal Returns

Trust The Professionals. Trust SD.

Tax Return Experts Serving PA, NJ, NY, DE, & More

Personal Tax Return Services in Bucks County, Montgomery County, & Philadelphia

Are you dreading the arrival of tax season? Preparing your own taxes can be a daunting task, especially if you have multiple sources of income or tax credits to consider. Without the right guidance, it’s easy to make mistakes that could reduce your tax refund or even put you at risk for legal repercussions. With our team of experts at SD Associates, P.C., you can rest assured that your tax return will be handled quickly and accurately. Don’t let the next tax season catch you unawares – get in touch with us today to schedule your consultation for personal tax returns in Bucks County and the surrounding areas.

The Tax Return Process

Create a Strategy

Before we begin preparing your taxes, we take the time to get to know you and your financial situation. This helps us create a customized tax strategy that will minimize your liability and ensure that you receive the maximum refund possible. We will collect all of the necessary documents from you that we’ll need to complete your tax return. This includes W-2 forms from your employer, 1099 forms for any freelance work or other income sources, and records of any deductions or credits you plan to claim like receipts.

Maximize Tax Deductions

We make it our mission to stay up-to-date on the latest tax laws so that we can help you take advantage of every deduction you’re eligible for. This includes deductions for things like mortgage interest, medical expenses, and charitable donations. If you can successfully claim deductions, it will lower your taxable income and increase the size of your refund.

Find Eligible Tax Credits

In addition to deductions, there are a variety of tax credits that can help reduce your overall liability. We can help you determine if you’re eligible for credits like the Earned Income Tax Credit or the Child and Dependent Care Credit. New tax credits can be added all the time, making it essential to consult a tax expert who stays on the forefront of tax law.

Develop a Payment Plan

While many people will receive tax return money, some individuals may owe taxes to the IRS. If you need to pay any taxes, we can help you develop a payment plan that makes sense for your budget. This will allow you to pay your taxes over time without incurring any additional penalties or interest charges.

Personal Tax Return FAQs

Why should I get my taxes professionally done?

You Want Maximum Deductions and Credits

Filing your taxes can be a complex process, and even small mistakes can have major consequences. By working with a professional tax preparer, you can avoid costly errors and ensure that you’re taking advantage of all the deductions and credits you’re entitled to.

You’re a Freelancer

If you’re an independent contractor or have a few side gigs, you’ll especially want to enlist a tax professional for your personal return. These types of jobs can come with their own rules and regulations that make it challenging for an individual to navigate. Our team of tax experts can help you make sense of 1099 forms and calculate your quarterly estimated taxes.

You Need to File Multiple State Returns

If you live in one state but work in another, you may need to file taxes in both states. This can become very confusing, and even small mistakes could result in costly penalties. Our professional tax preparers at SD Associates, P.C. have experience with multiple-state taxation and can ensure that your return is filed correctly.

You Owe Taxes

What happens if you wind up owing tax money? We can help you develop a payment plan if you need to owe any taxes, so that you can avoid penalties and interest charges without making a huge impact on your cash flow.

You Have a Stock Portfolio

If you’ve invested in stocks, you may need to pay capital gains taxes on your profits. These can be complex to calculate, and even a small mistake could result in overpaying or underpaying your taxes. There are usually additional forms to fill out for taxpayers with multiple investments, which further complicates the process. Our tax experts can help you navigate the ins and outs of capital gains taxes to ensure that you’re paying the right amount.

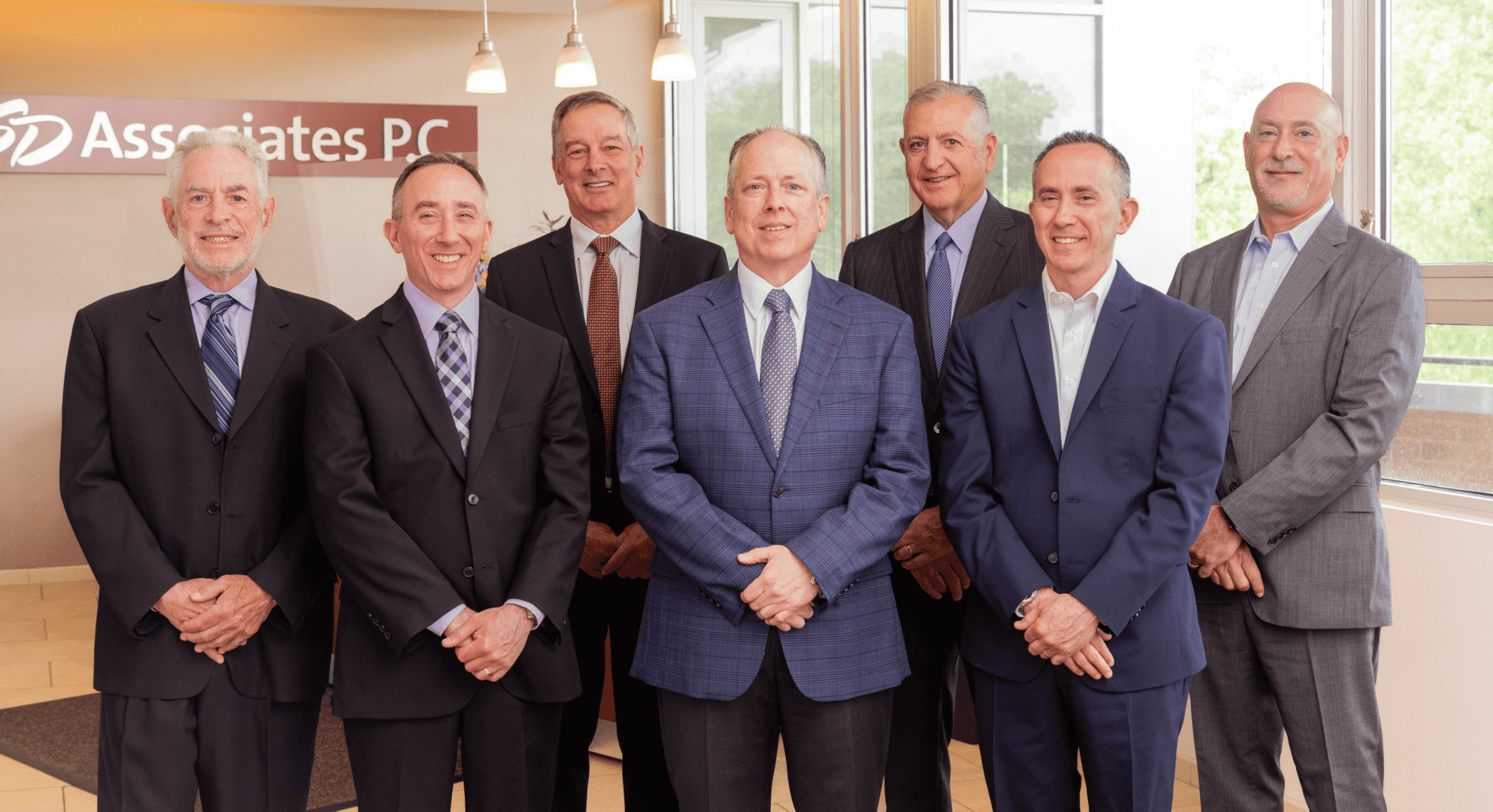

Why SD Associates, P.C.

Unparalleled service: There’s a reason SD Associates, P.C. is the best kept secret in the tri-state area. Our full-service accounting firm offers the wide range of services associated with a large company, but is still small enough to provide personal tax returns in Bucks County, Montgomery County, Philadelphia, and the surrounding areas. Our team of six shareholders and associates work tirelessly to ensure that you get the maximum refund.

High professional standards: We adhere to all of the American Institute of Certified Public Accountants (AICPA) auditing standards, guidelines, rules and regulations. Our quality control system has been reviewed by the Pennsylvania Institute of Certified Public Accountants and has received the highest possible rankings.

Wide client base: We have worked with individuals from a wide variety of backgrounds and financial situations. No matter what your tax situation, we can provide you with the highest level of service.

Accessibility: We strive to make ourselves accessible to our clients when they need us most. Our team promptly responds to all emails, and we are always available for a phone call if you need advice or have a question. You’ll never have to wonder if your records are up to date or if your tax return has been submitted. We always stay in touch with you to ensure that everyone is on the same page.

Personal Tax Return Service Areas

SD Associates, P.C. is proud to provide exceptional personal tax return services in the Tri-State area. Our service areas include, but are not limited to:

- Philadelphia, PA

- Bucks County, PA

- Montgomery County, PA

- Chester County, PA

- Lehigh County, PA

- North Jersey

- South Jersey

- Maryland

- Delaware

Call Today for Personal Tax Returns in Bucks County, Montgomery County, & Philadelphia

Searching for ‘tax services near me?’ SD Associates, P.C. is the only name you need to know for personal tax returns in Bucks County, Montgomery County, and Philadelphia. Our team can help you file your personal tax return on time and avoid any penalties. Get in touch with us today to schedule your consultation with one of our personal tax experts.

Ask a Question

Do you have a question about tax services, attestation, bookkeeping, or our other financial services? Click here to ask one of our financial experts.

Newsletter

Keep up with the latest developments in taxes, finance, and all things SD Associates, P.C. by signing up for our newsletter.

Experience The SD Difference

Why Our Clients Love Us

Accountants Serving Philadelphia, Bucks County, Montgomery County, & Surrounding Counties

Looking For More From Your CPA?

When you partner with SD Associates, P.C., you’re working with a top-notch team of knowledgeable tax professionals. With over 3 decades of experience, we strive to provide our clients with the highest level of service.

Full-service CPA Firm

Over 35 Years in Business

Always Available for Phone Calls

Accessible Via Email or Phone

Wide Client Base

Experienced CPAs with Advanced Degrees

Service Areas

Communities We Serve

Navigation

Services

Accolades