- Home

Why Choose SD

Services

- Services

Tax Services

Tax Planning

Attestation Services

Accounting Services

Business Services

Consultation

Industries We Serve

- Tax Center

Resources

Get In Touch

SD Associates, P.C. CPAs

Partnership Accounting Services

Experience The SD Difference

Partnership Returns

Trust the Tax Professionals. Trust SD.

Partnership Tax Experts Serving PA, NJ, NY, DE, & More

Partnership Accounting Services in Philadelphia, Bucks County, & Montgomery County

As a partnership, you are required to file a tax return each year. This can be a complex and time-consuming process, especially if you have multiple partners. SD Associates, P.C. can help ease the burden of filing your partnership tax return. We have experience preparing tax returns for all types of partnerships, from small businesses to large corporations. Your partnership tax return CPA in Philadelphia, Bucks County, and Montgomery County can help with business relationships of every type and size. Reach out to our team of tax experts today to schedule your initial consultation.

The Advantages of Professional Tax Services

If you need to file a partnership tax return, it can be extremely helpful to consult with one of our tax professionals at SD Associates. Our tax experts can help ensure that your return is filed correctly, and they can also provide valuable advice on how to reduce your tax liability. With so many additional forms needed for a partnership tax return, it’s easy to inadvertently supply incorrect information or neglect to submit an important document.

Partnership tax returns are often due before personal tax returns, which makes it even more essential to work with a tax professional. If a tax return is not submitted on time, the IRS may impose penalties or interest charges. These charges can quickly add up, and they can be very difficult to remove. Your cash flow could be severely impacted if you are unable to pay these charges. Avoid the stress of legal tax fees with our team of partnership tax experts. Extensions are generally granted to those who apply, giving you a six month extension to file.

Partnership Tax Return FAQs

What is a partnership tax return?

A partnership tax return is a document filed with the Internal Revenue Service (IRS) that reports the income, expenses, and other financial information of a partnership. This return is used to calculate the taxes owed by the partnership. A partnership is defined as an association of two or more people who carry on a business together. These individuals agree to combine resources and share profits. Partnerships can be formed for various business purposes, such as to jointly own and operate a business. Common examples of partnerships include law firms, accounting firms, real estate investment companies, and medical groups.

Do partnerships pay income taxes?

According to the Internal Revenue Service (IRS), partnerships are required by law to report financial data like income, deductions, gains, and losses on a yearly basis. It’s essential to note that the partnership will not pay income tax – rather, it will pass on the gains or losses to the partners. Each member of the partnership must then report these figures on their personal tax returns. The partnership will also file an information return, which is used to provide the IRS with data about the partnership’s finances.

What are the different types of partnerships?

There are three main types of partnerships: general partnerships, limited partnerships, and limited liability partnerships.

A general partnership is an association of two or more people who carry on a business together for profit. All partners are equally liable for the debts and obligations of the partnership. This means that each partner is personally responsible for the debts of the business, even if they did not sign any loan agreements or contracts.

A limited partnership is an association of two or more people in which there are both general and limited partners. The general partners manage the business and are personally liable for its debts. The limited partners are only liable for the amount of money they invested in the partnership.

A limited liability partnership is an association of two or more people who have formed a partnership to carry on a business for profit. This type of partnership protects each partner from being held responsible for the debts and obligations of the partnership.

What forms are needed for a partnership tax return?

A partnership tax return does not include a W-2, as partners are not considered employees. They must submit a copy of Form 1065 (also known as Schedule K-1) on behalf of the partnership.

In addition to Form 1065, individuals in a partnership may need to fill out separate documents like Form 1040 (Schedule E) or Form 965-A (Individual Report of Net 965 Tax Liability).

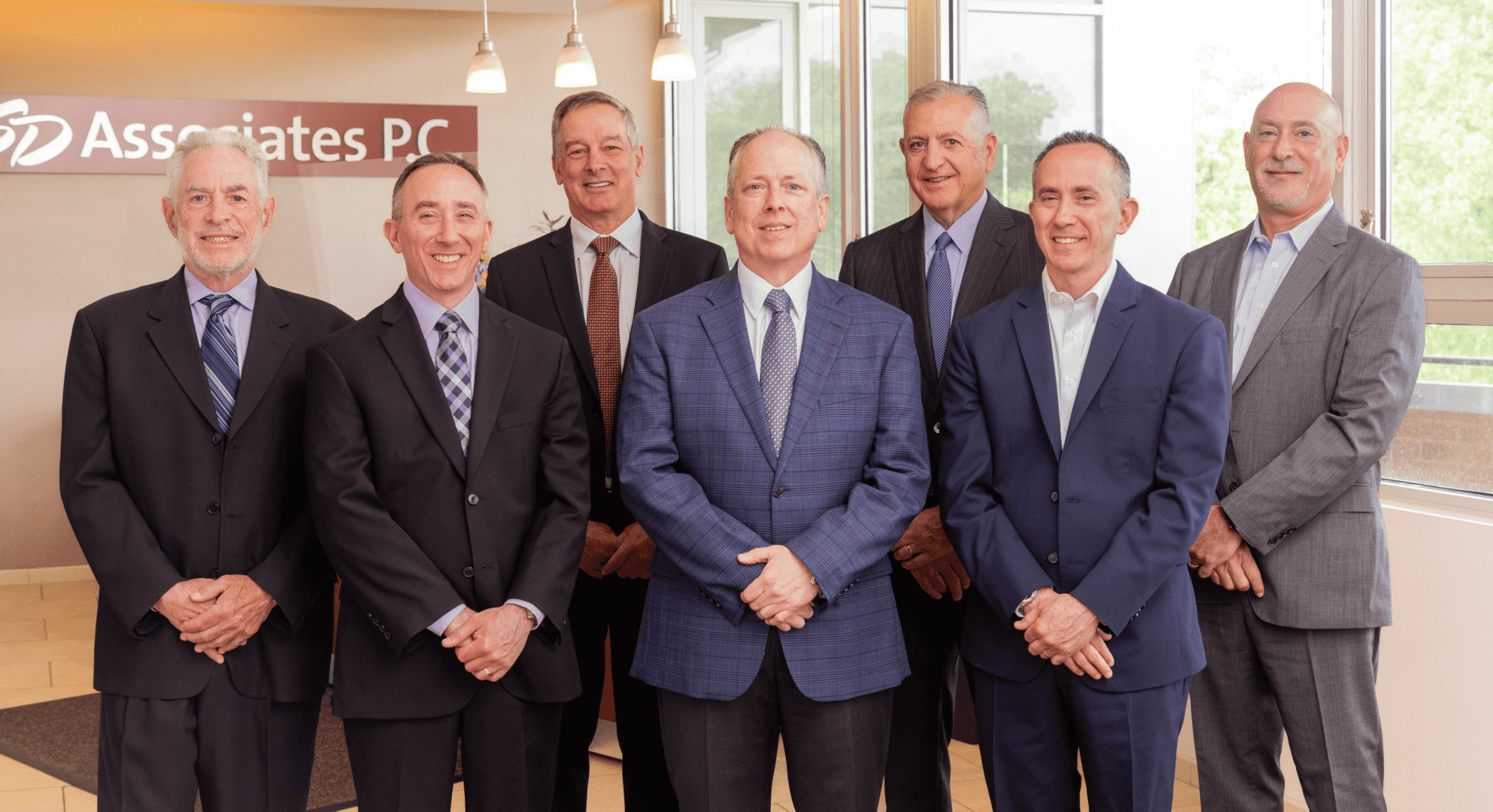

Why SD Associates, PC

Unparalleled service: There’s a reason SD Associates, P.C. is the best kept secret in the tri-state area. Our full-service accounting firm offers the wide range of services associated with a large company, but is still small enough to provide partnership tax returns in Bucks County, Montgomery County, Philadelphia, and the surrounding areas. Our team of six shareholders and associates work tirelessly to ensure that your partnership gets the maximum benefits.

High professional standards: We adhere to all of the American Institute of Certified Public Accountants (AICPA) auditing standards, guidelines, rules and regulations. Our quality control system has been reviewed by the Pennsylvania Institute of Certified Public Accountants and has received the highest possible rankings.

Wide client base: We have worked with individuals from a wide variety of backgrounds and financial situations. No matter what type of partnership you hold, we can provide you with the highest level of service.

Accessibility: We strive to make ourselves accessible to our clients when they need us most. Our team promptly responds to all emails, and we are always available for a phone call if you need advice or have a question. You’ll never have to wonder if your records are up to date or if your tax return has been submitted. We always stay in touch with you to ensure that everyone is on the same page.

Areas We Serve

SD Associates, P.C. is proud to provide professional partnership tax return services in the tristate area. Our service areas include, but are not limited to:

- Philadelphia, PA

- Bucks County, PA

- Montgomery County, PA

- Chester County, PA

- Lehigh County, PA

- North Jersey

- South Jersey

- Maryland

- Delaware

Contact Our Partnership Tax Return CPA in Bucks County, Montgomery County, & Philadelphia

Searching for ‘tax services near me?’ SD Associates, P.C. is the best kept secret in the tri-state area for partnership tax returns in Bucks County, Montgomery County, and Philadelphia. Get in touch with us today to schedule your consultation with one of our partnership tax experts.

Ask a Question

Do you have a question about tax services, attestation, bookkeeping, or our other financial services? Click here to ask one of our financial experts.

Newsletter

Keep up with the latest developments in taxes, finance, and all things SD Associates, P.C. by signing up for our newsletter.

Experience The SD Difference

Why Our Clients Love Us

Accountants Serving Philadelphia, Bucks County, Montgomery County, & Surrounding Counties

Looking For More From Your CPA?

When you partner with SD Associates, P.C., you’re working with a top-notch team of knowledgeable tax professionals. With over 3 decades of experience, we strive to provide our clients with the highest level of service.

Full-service CPA Firm

Over 35 Years in Business

Always Available for Phone Calls

Accessible Via Email or Phone

Wide Client Base

Experienced CPAs with Advanced Degrees

Service Areas

Communities We Serve

Navigation

Services

Accolades